Consumer Handbook on

Adjustable-Rate Mortgages

Find out how your payment can change over time.

How to use the booklet

When you and your lender discuss adjustable-rate mortgages (ARMs), you receive a copy of this booklet. When you apply for an ARM loan, you receive a Loan Estimate. You can request and receive multiple Loan Estimates from competing lenders to find your best deal.

You may want to have your Loan Estimate handy for any loan you are considering as you work through this booklet. We reference a sample Loan Estimate throughout the booklet to help you apply the information to your situation.

You can find more information about ARMs at cfpb.gov/about-arms. You’ll also find other mortgages-related CFPB resources, facts, and tools to help you take control of the home buying options.

About the CFPB

The Consumer Financial Protection Bureau regulates the offering and provision of consumer financial products and services under the federal consumer financial laws and educates the and empowers consumers to make better informed financial decisions.

This booklet, titled Consumer handbook on Adjustable Rate Mortgages, was created to comply with federal law pursuant to 12 U.S.C 2604 and 12 CFR 1026.19(b)(1).

How can this booklet help you?

This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the home buying process.

Your lender may have already provided you with a copy of Your Home Loan Toolkit. You can also download the Toolkit from the CFPB’s Buying a House Guide at cfpb.gov/buy-a-house/.

An ARM is a mortgage with an interest rate that changes, or “adjusts,” throughout the loan.

With an ARM, the interest rate and monthly payment may start out low. However, both the rate and the payment can increase very quickly.

Consider an ARM if you can afford increases in your monthly payment-even to the maximum amount.

After you finish this booklet:

- You’ll understand how an ARM works and whether it’s the right choice for you.

- You’ll know how to review important documents when you apply for and ARM.

- You’ll understand the risks that come with different types of ARMs.

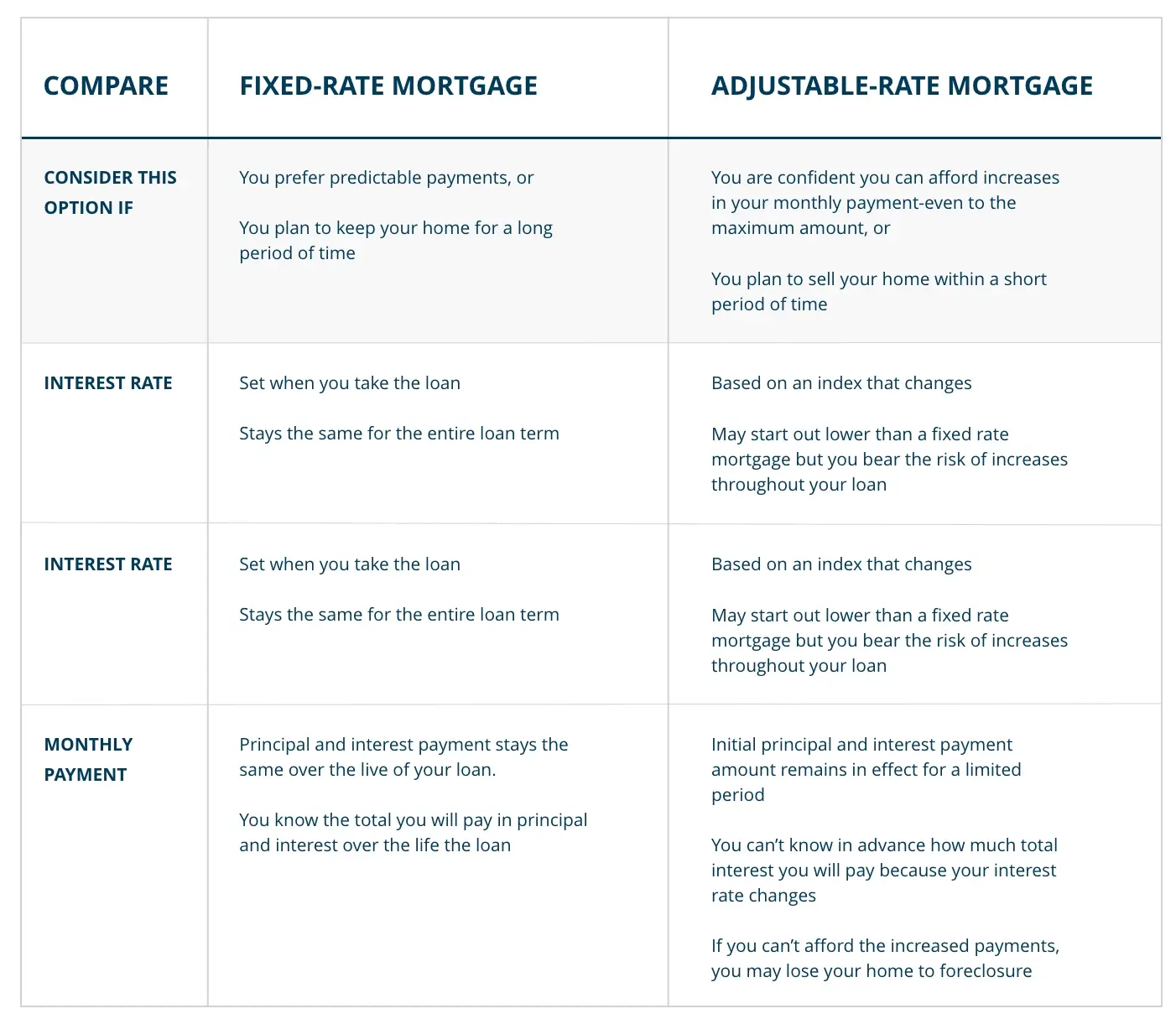

Is an ARM right for you?

ARMs come with the risk of higher payments in the future that you might not be able to predict. But in some situations, an ARM might make sense for you. If you are considering an ARM, be sure to understand the tradeoffs.

Learn about how ARMs work

As you decide whether to move ahead with an ARM, you should understand how they work and how your housing costs can be affected.

Interest rate = index + margin

The interest rate on an ARM has tow parts: the index and the margin.

INDEX

An index is a measure of interest rates generally that reflects trends in the overall economy. Different lenders use different indexes for their ARM programs.

Common indexes includes the U.S. prime rate and the Constant Maturity Treasure (CMT) rate. Talk with your lender to find out more about the index they use, which is also shown on your Loan Estimate.

MARGIN

The margin is an extra percentage that the lender adds to the index.

You can shop around to different lenders to find the lowest combination of the index plus the margin. Your Loan Estimate shows the index and the margin being offered to you.

Changes to the initial rate and payment

The initial interest rate and initial principal and interest payment amount on an ARM remain in effect for a limited period.

So, when you see ARMs advertised as 5/1 or 5/6m ARMS:

- The first number tells you the length of time your initial interest rate lasts.

- The second number tells you how often the rate changes after that.

For example, during the first five years in a 5/6m ARM your rate stays the same. After that, the rate may adjust every size months (the 6m in the 5/6m example) until the loan is paid off. This period between rate changes is called the adjustment period. Adjustment periods can vary. Some last a month, a year, or like this example, six months.

For some ARMs, the initial rate and payment can be very different from the rates and payments later in the loan term. Even if the market for interest rates is stable, your rates and payments could change a lot.

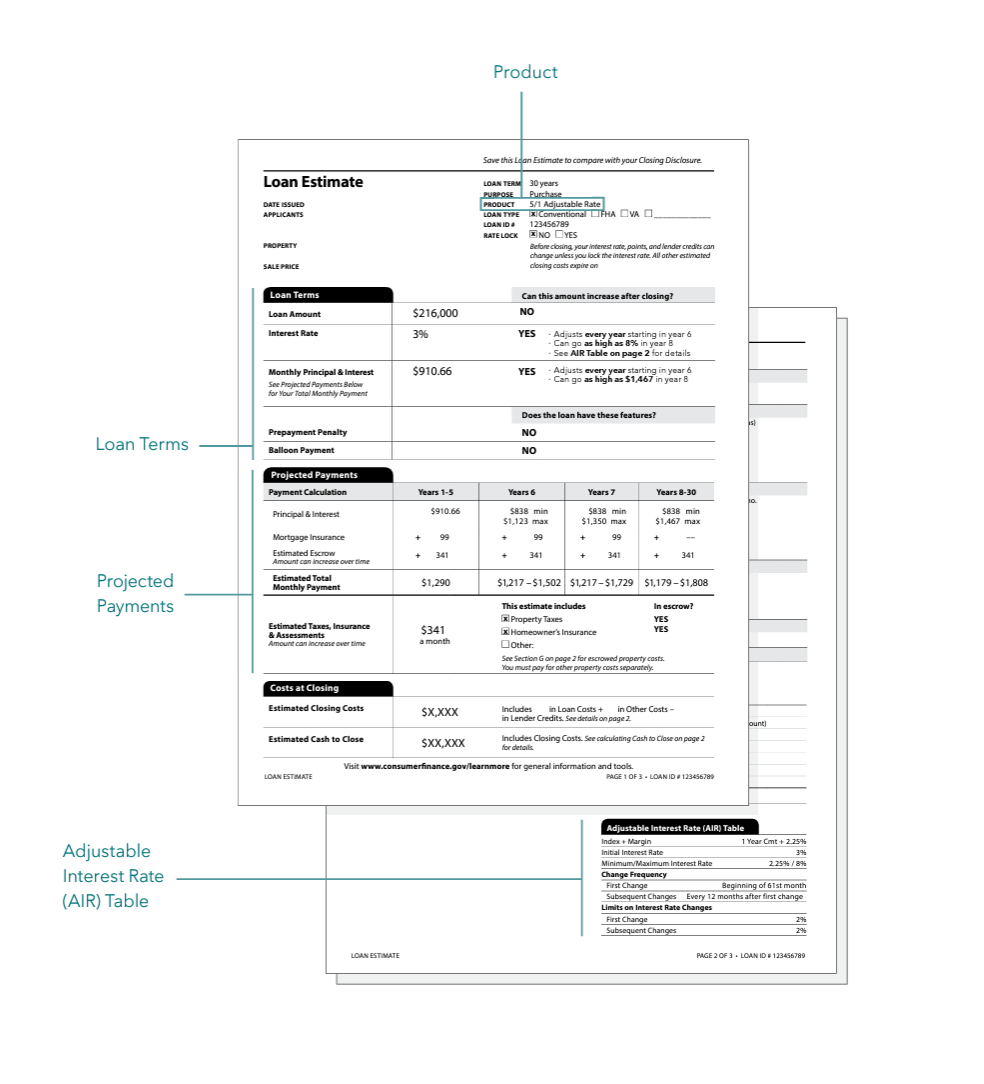

Use your Loan Estimate to understand your ARM

When you apply for a mortgage, the lender gives you a document called a Loan Estimate. It describes the important features of the loan the lender is offering you. This section illustrates the part so a loan estimate that are specific features of ARM loans. An interactive, online version of a Loan Estimate sample is available at: cfpb.gov/arm-explainer/

Loan Terms

INTEREST RATE

The Loan Estimate shows the initial interest rate you pay at the beginning of your loan term. This row also shows how often your rate can change and how high it can go.

Monthly Principal & Interest

The Loan Estimate shows the initial monthly principal and interest payment you’ll make if your accept this loan. Your principal is the money that you originally agreed to pay back on your loan. Interest is a cost you pay to borrow the principal. The initial principal and interest payment amount for an ARM is set only for the initial period and may change after that.

THE TALK

You Might hear, “An ARM makes sense because you can refinance the loan before your interest rate and monthly payment increase.”

Ask yourself, a spouse or a loved one:

“What if the market value of the home goes down?”

What if our financial situation or credit score gets damaged by something unexpected like a job loss or illness?”

“If we can’t refinance at a better rate, can we afford the maximum interest rate and payment increase under this loan?”

Projected Payments

Principal & Interest

The monthly principal and interest payment on your ARM is likely to change after the initial period. Review the Section to see how your payment can change based on your loan’s interest rate.

ESTImated total MontHly Payment

Review this row to see the total minimum and maximum monthly payments. The payments include mortgage insurance, property taxes, homeowners insurance, and any additional property assessments or other escrow items. Learn more about these mortgage terms at cfpb.gov/mortgage-terms/.

Keep in mind that other parts of your monthly and annual housing costs can change, such as your property taxes and homeowners insurance payments.

THE TALK

Talk over how your financial life could be affected if your ARM monthly payment increases. In future years, you might face money decisions like:

Job Changes

School or other education expenses

Medical needs and expenses

Because ARM adjustments are unpredictable, you might have less or more financial flexibility for other parts of your life.

Adjustable Interest Rate (AIR) Table

You should read and understand the AIR table calculations before committing to an ARM. It’s important to know how your interest rate changes over the life of your loan.

Index + Margin

Your lender is required to show you how your interest rate is calculated, which is determined by the index and margin on your loan.

Initial Interest Rate

This is the interest rate at the beginning of your loan. The initial interest rate changes to the index plus the margin at your first adjustment (subject to the limits on interest rate changes). Your loan servicer tells you your new payment amount seven to eight months in advance, so you can budget for it or shop for a new loan.

Change Frequency

This indicates when the interest rate on your loan will change. Your loan servicer sends you advance notices of changes.

Limits on Interest rate changes

This shows the highest amount your interest rate can increase when there is a change.

“Teaser” Rates

Some lenders offers a “teaser,” “Start,” or “discounted” rate that is lower than their fully indexed rate. When the teaser rate ends, your loan takes on the fully indexed rate. Don’t assume that a loan with your a teaser Tate is a good one for you. Not everyone’s budget can accomodate higher payment.

Consider this example:

A lender’s fully indexed rate is 4.5% (The index is 2% and the margin is 2.5%)

The loan also features a “teaser” rate of 3%

Even if the index doesn’t change, your interest rate still increases from 3% to 4.5% when your teaser rate expires.

The Talk

You are in control of theater or not to proceed with an ARM. If you prefer to proceed with a fixed-rate mortgage, here is one way to start the conversation with a lender:

“A fixed-rate mortgage seems to be a better fit for me. Let’s talk about what you can offer and how it compares to other loans I may be able to get.”

Review your lender’s ARM program disclosure

Your lender gives you an ARM program disclosure when you give you an application. This is the lender’s opportunity to tell you about their different ARM loans and how the loans work. The index and margin can differ from one lender to another, so it is helpful to compare offers from different lenders.

Generally, the index your lender uses won’t change after you get your loan, but your loan contract may allow the lender to switch to a different index in some situations.

Gather Facts

Review your program disclosure and ask your lender questions to understand their ARM loan offerings:

- How are the interest rate and payment determined?

- Does this loan have interest-rate caps (that is, limits on interest rate changes)?

- How often do the interest rate and payment adjust?

- What index is used and where is it published

- Is the initial interest rate lower than the fully indexed rate?

- What type of information is provide in notices of adjustment and when do I receive them?

Ask about other options offered by your lender

Conversion Options

Your loan agreement may include a clause that lets you convert the ARM to a fixed-rate mortgage in the future.

When you convert, the new rate is generally set using a formula given in your loan documents. The fixed rate may be higher or lower than interest rates available to you in the market at that time. Also your lender may charge you a conversion fee. Ask your lender whether the loan you are being offered has a conversion feature and how it works.

Special Features

You can shop around to understand what special ARM features may be available from different lenders.

Not all programs are the same. Talk with your lender to find out if there’s anything special about their ARM programs that you may find valuable.

Check your ARM for features that could pose risks

Some times of ARMs have features that can reduce your payments in the short term but may include fees or the risk of higher payments later. Review your loan terms and make sure that you understand the fees and how your rate and payment may change. Lower payments at the beginning could mean higher fees or much higher payments later.

Paying points reduce your initial interest rate

Lenders can offer you a lower rate in exchange for paying loan fees at closing, or points.

With an ARM, paying points often reduces your interest rate only until the end of the initial period–the reduction most likely does not apply over the life of your loan.

If you are using an ARM to refinance a loan, points are often rolled into your new loan amount. You might not realize you are paying points unless you look carefully. Points are disclosed on the top of Page 2 of your Loan Estimate.

Lenders may give you the option to pay points, but you never have to take that option. TO figure out if you have a good deal, compare your cost in points with the amount that you will save with a lower interest rate.

THE TALK

If your Loan Estimate shows points, ask your lender:

“What is my interest rate if I choose not to pay points?”

“How much money do I pay in points? And, compared to the total reduction in my payments during the initial period, am I coming out ahead?”

Can I see a revised Loan Estimate with the points removed and the interest rate adjusted?”